The Automotive category spent about $3.6billion on advertising in the US across the period April-June 2013. For a full marketing spend you could comfortably double that figure. It is the second largest adspend category (behind retail) in the US and it grew at 6.9% quarter on quarter, according to Kantar Media Research. Globally Automotive represents c.10% of total advertising expenditure.

The Automotive category is relatively consolidated versus other categories with large players such as GM, Ford, and Toyota having high shares of category expenditure compared to market leaders in retail, or FMCG. Ford is ranked the 4th largest advertiser in the World, GM the 5th, and Toyota the 6th. The Automotive category is marketing intensive and has control over many of the marketing channels it uses to sell cars, from advertising and sponsorships, through digital and CRM, to dealer and experiential.

So it is, given its size and diversity, very interesting to look at the Automotive category’s approach to integrated marketing to find insights and implications for marketing and procurement

Flock Associates have teamed up with Integration Integration IMC to analyse trends of their research into the Automotive category since 2003. The research looks at the influence of up to 35 consumer touch points, and the attribution of advertisers’ activity to these contact points. This research allows clients to understand:

- What are the most influential touch points

- Which of these touch points is working best for them, versus the competition

- By adding marketing expenditure by channel the client can ascertain what is the cost effectiveness of each channel

- By sampling against different stages of the purchase funnel, the client can improve conversions

- By having a “common currency” for analysis the client can analyse period-on-period changes, and compare and contrast markets.

Integration IMC have worked with 10 different automotive clients across 20 markets, since 2003.

Interesting Observations

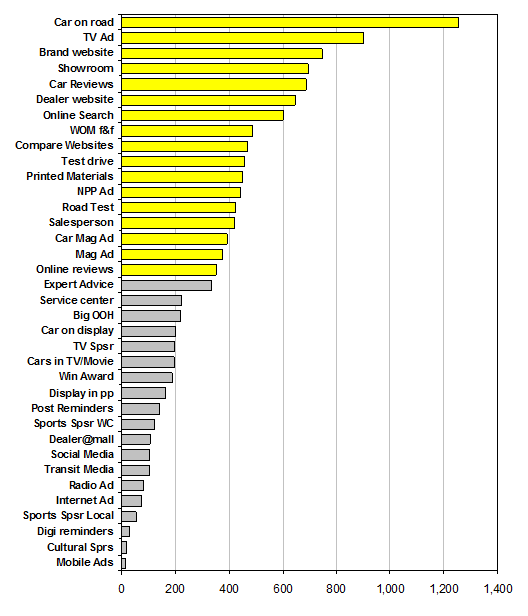

Firstly, when the most influential consumer touch points are ranked, trusted sources of information (car reports etc), 1-2-1 personal experience (like test drives, car rental, seen on the road or dealer forecourt), and digital contacts (like websites and reviews) come out on top.

The chart below shows the ranking of each of the touch points based upon their impact. These highly impactful word of mouth touch points are often not fully utilised by the automakers, despite their power. The same is true in many other categories, probably they are hard to control, and measure.

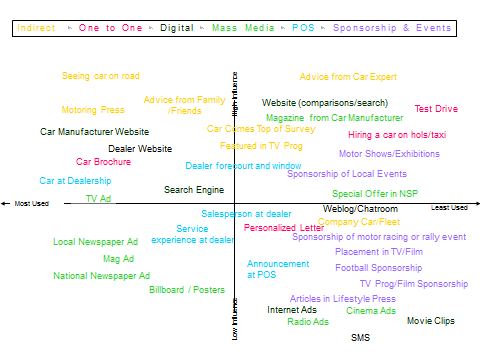

The chart below shows a slightly different set of touch points shown graphically where;

- Most influential and least used – top right quadrant

- Most influential and most used – top left quadrant

- Least influential and most used – bottom left quadrant

- Least influential and least used – bottom right quadrant

It can be seen that “traditional media” which still attracts c.80% of marketing expenditure are amongst the lowest influence touch points. Many automakers are not fully embracing the content marketing revolution, but this is also true in many other categories. Having a clear measure of the roles and competitive pressure on each consumer touch point allows smart decisions to be made.

Since 2003 we have seen, unsurprisingly, the influence and importance of 1-2-1 and social media increase by +64% and digital increase by +35%. Also, the digital media are now so creatively “engaging” they rank alongside TV advertising as the most engaging of all media channels.

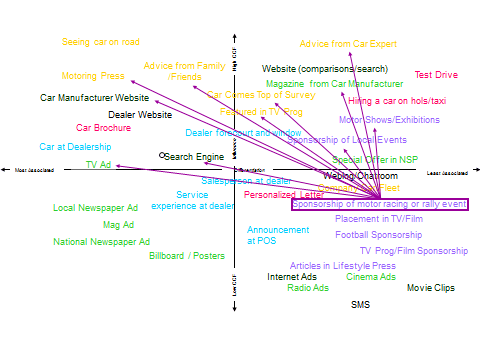

Sponsorship is a great trade tool for hospitality etc, but seems to always rank poorly as an influential consumer touch point. And yet car manufacturers sponsor motorsports teams, and many other sports event and social events as well. These sponsorships often only make any commercial sense when they are extremely well integrated across channels, linking to those more influential channels, as the chart below shows.

Interestingly, the consumer touch points rank similarly across different car segments from luxury to economy and from SUV to Mini.

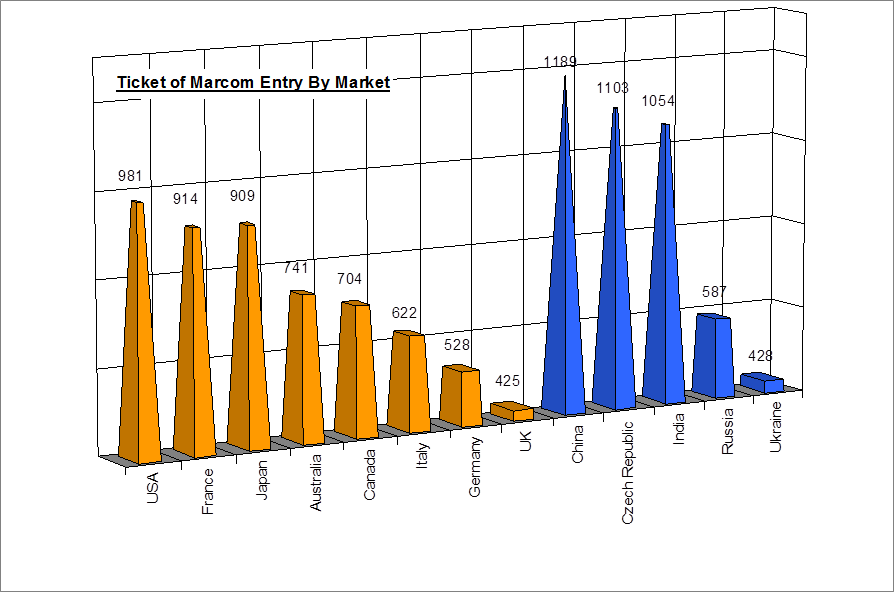

However, there are quite large variations by geography.

For example Northern European consumers value informational based touchpoints more highly than Latin countries consumers, who value experiential touch points more.

Furthermore, since 2003 we have witnessed a growth in the levels of engagement in emerging economy countries – the consumers are now on average +20% more engaged in automotive communication than their developed world counterparts. This has big implications for budget setting across the world, but also for long term planning for marketing.

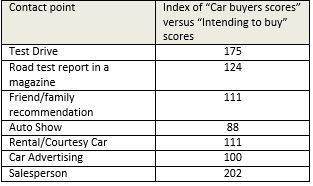

The research also allows the consumer sample to be broken down into the different purchase funnel stages; from those who are not even thinking of buying a car, to those who are researching, and those just about to buy etc. The relevance and power of the different consumer touch points can be seen at different stages of the funnel. The chart below indexes the scores for different touch points of those actually in the process of buying a car versus those just “intending to buy” at some stage in future.

So using this information you can tailor plans to different parts of the purchase funnel, or see how each element of generic plan performs at each stage.

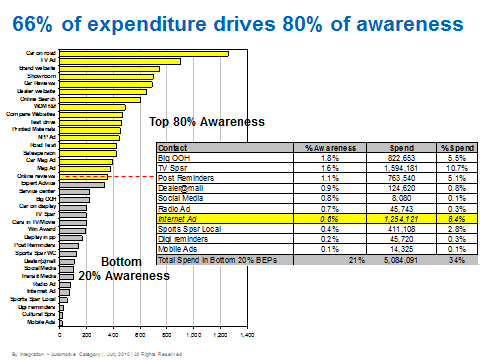

Lastly, what is really clever is when costs are attributed to the different touch points. A client can then analyse what return they get for their marketing expenditure by channel. The chart below shows an example of how this analysis can help a client optimise their plans. In this instance the Car manufacturer is spending quite a lot of money (c.$5million) on touch points that are not delivering much awareness for them. In the “box” you can see that the client spent $822k on Big OOH advertising which was 5.5% of their budget, but it only yielded a 1.8% share of that brands awareness. If this was switched to more productive channels big efficiency gains could be made

So, what are the implications for marketers and procurement from these research studies?

1. You need a great measure of effectiveness for integrated marketing

All marketers, whatever the category need a measure of effectiveness across all marketing channels. See here for our previous blog on measuring advertising effectiveness. If you do not have the sort of information that the research we have shown provides, you really should set out to get it!

2. You need Integrated Ideas

The study of the automotive sector shows exactly how influential each of the touch points are, and how they need to work together to be effective. It is clear that in this “integrated marketing age” ideas beyond advertising are absolutely required, and the ideas need to be executed seamlessly from brochure, website, dealer, through to TV. It is, however, still shocking to see/hear/feel how fragmented many car launches are and how often ideas begin with TV, and work “down” into other channels. The research clearly shows that ideas need to work from the car out towards TV and other mass media.

Building integrated idea frameworks and processes may need a reengineering of processes. And, the process reengineering is as required for Retail and FMCG as it is in Automotive.

At Flock we have strong credentials in building integrated campaigns and processes and have built an extensive library of integrated case histories. We also have an encyclopaedic knowledge of the process to deliver great work like this.

3. You need to review your budgeting and channel planning processes

The majority of car manufacturers have not radically changed their budgeting processes or their channel planning processes. It is clear from the car research studies that most car manufacturers are relying on mass media, and have not moved quickly enough to capitalise upon the opportunities that 1-2-1, Social and Digital offer. This same trend is true for many categories of advertiser. The growth in influence of these new channels requires different ways of setting budgets, and planning.

In addition, there are large differences by market. Without the means to compare and contrast the effectiveness of budgets across markets, the global marketer is “blind”. He or she needs the granular detail of effectiveness by channel to deliver appropriate “tool kits” and campaigns. Having a “neutral and objective” piece of research like we used in this blog can facilitate budgeting conversations.

4. You need to continually review your agency ecosystem’s capabilities and integrated processes

Many automotive clients (and others!) are very reliant on their agencies. The changes in the consumer landscape dictate quite large and fast changes that may not be in the agencies’ interest to pursue. Certainly the advertising and media agency has to adapt rapidly to deliver an automotive client the sort of 1-2-1, social and digital campaigns they need.

The amount of content required to power the Social and Digital networks is high, the conventional model of developing this content is slow, and too expensive. Many clients are considering production decoupling to allow them to benefit from the benefits of content marketing, at a quality, consistency and price that makes commercial sense.

The new landscape requires all the marketing channels to be brilliantly executed individually, but more importantly, all together. As just one example, we can see from the analysis above that a sponsorship may only make sense if brilliantly integrated across channels. This requires a different approach to integration. We have seen some car manufacturers try and tackle this in different ways for example, Ford with their Bluehive agency – incorporating many WPP assets in one agency, Nissan announcing something similar (Nissan United – which is a bit like “back to the future” as in the past TBWA/Chiat Day had an agency called G1 specifically to service Nissan) and we have seen Spark44, Jaguar’s part owned agency roll-out across several major markets. Toyota and VW Group had adopted different, more or less traditional models, and the Korean Hyundai and Kia use a combination of in-house and external resources.

Whatever strategy you choose, you should ensure that YOU THE CLIENT choose the approach, not allow the agency to dictate a route that is designed to protect their revenue streams!

5. Procurement need benchmarks of outcomes and value, not inputs and cost

Procurement is well established in the automotive sector and will of course have looked at the raw cost of media and each agency service. However, if armed with a common currency for VALUE for each communication channel (like the examples we have shown), they can engage with their marketing colleagues at a more strategic level. They are also much better informed about the value that agencies can add. They also have a framework for comparison across markets.

The information of outcomes and value, allow procurement to build a long term sustainable set of relationships with agencies based upon ACTUAL PERFORMANCE, rather than hours and service levels.

You can read more about integrated marketing procurement here.

So, we have looked at one of the largest advertising categories, automotive, and using data from Integration IMC, picked out some key insights for marketers and procurement that we believe may be relevant for many categories.

Should you wish to know more about the research shown above, or you would like to know how to implement changes to your marketing ecosystem, whether you are an Aston, an Auris, a Jeep or a Jaguar then please do not hesitate to call us or contact us here.

Comment Policy: Thanks for visiting the Flock Blogging page, where we welcome your comments. Since this is a moderated blog, all comments will be reviewed prior to posting. As a result, there will be a delay in the posting of comments and not all comments will be posted. Comments may also be removed after they are posted. Thank you for your understanding.