Why CMOs and Agencies Need to Fix the Foundations Before Rewiring Commercial Models

The phrase “do more with less” has evolved from corporate cliché to daily survival strategy for many CMOs. As marketing budgets decline and scrutiny from finance intensifies, agencies are responding with an increasingly familiar offer: asset-based pricing (also known as output- or deliverables-based cost structures). On the surface, it sounds like a no-brainer: pay for outputs, not hours. Simpler, more accountable, more efficient.

But here’s the uncomfortable truth: most marketers—and many agencies—aren’t set up to make asset-based pricing successful. Worse, rushed implementation can erode value rather than unlock it.

The Growing Temptation of Output-Based Pricing

The forces driving interest in asset-based pricing are undeniable.

- Marketing budgets flatlining at ~7-8% of revenue (Gartner, 2025)

- CFOs demanding clearer, predictable cost structures

- Agencies seeking to de-commoditize services and tie fees to tangible deliverables

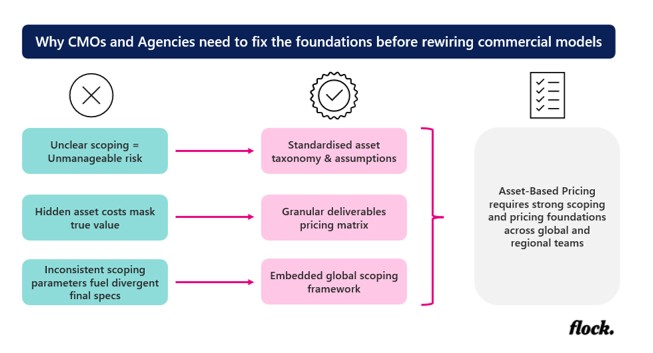

But our experience advising global marketers tells a more complex story. While the appeal of output-based pricing is real, its success depends entirely on solving three stubborn problems that plague marketing operations:

- Unclear Scoping = Unmanageable Risk

We often see asset-based deals undermined by ambiguous scopes of work. What exactly constitutes an “asset”? A social post? A six-second cutdown? A version for every language market? Without precise definitions, agencies hedge with inflated pricing, or costs spiral mid-project.

✅ Flock Guidance:

Asset-based pricing only works when accompanied by rigorous scoping hygiene—standardized asset taxonomies, transparent adaptation assumptions, and clear briefing protocols across markets.

- Hidden Asset Costs Mask True Value

Many current deals bundle asset creation into broad deliverable packages—production, activation, influencer content—obscuring real unit costs. CMOs lose line of sight to efficiency drivers, while procurement lacks leverage for comparison or negotiation.

✅ Flock Guidance:

Decouple asset costs from blended packages. Create transparency through granular deliverables pricing matrices, distinguishing concept development, production, and adaptations.

- Inconsistent Scoping Parameters Fuel Inequity

Flock’s diagnostics reveal wide inconsistencies in scopes between agencies, markets, and even campaigns:

- Rounds of stakeholder reviews

- Number of final formats/specs

- Level of creative complexity

These gaps introduce commercial friction, delay timelines, and ultimately breed dissatisfaction on both sides.

✅ Flock Guidance:

Embed a global scoping framework anchored to complexity tiers and standard service levels—ensuring predictable, equitable pricing while allowing local flexibility.

Beyond the Buzzwords: Making Output-Based Pricing Work

Done right, asset-based pricing aligns incentives: agencies focus on value creation, marketers gain clarity and predictability, and procurement secures commercial fairness. But the foundational work cannot be skipped:

✔️ Standardize asset definitions and taxonomies

✔️ Create transparent cost matrices for global and regional teams

✔️ Align stakeholders on scoping governance and approval processes

✔️ Tie pricing structures to both outputs and strategic brand objectives—not just volume

Crucially, CMOs must resist the allure of outcome-based pricing as a quick fix. Without setting up operational foundations, output-based deals risk becoming another shiny object with disappointing results.

What the Industry Is Saying

AI Disrupts Agency Time-Based Billing

- As tools like generative AI streamline creative workflows, agencies are questioning the viability of hourly billing. Executives from WPP and S4 Capital note that clients increasingly prefer output or outcome-based pricing instead of paying for hours—reinforcing the need for asset-based models.

Agency Practices Reveal Scope Creep & Profit Drains

- A 2025 survey of 270+ U.S. agencies found that nearly 79% of agencies over-serve without billing for the extra work, highlighting how scope creep undermines profitability—and why clear asset scoping is vital.

Our Perspective

Flock has helped the world’s leading marketers navigate this pricing evolution—designing commercial models that reflect real-world complexities while building agency partnerships rooted in accountability and mutual value. Our belief? Pricing innovation is essential, but only when underpinned by operational excellence and clear definitions.

Asset-based pricing isn’t just a finance conversation—it’s a brand governance and marketing effectiveness conversation. It demands alignment between marketing, procurement, agencies, and finance.

If you’re exploring asset-based or outcome-based pricing, ask yourself: have we built the operational scaffolding to make it succeed? If not, that’s the real place to start.

Want to pressure-test your readiness for asset-based pricing? Let’s talk.

Contact us