Back in 2016, the media and marketing industry was shaken by a ‘bombshell’ report on transparency that was published by K2 Intelligence, on behalf of the ANA. The report brought to light a number of trading practices many media houses were undertaking that were undisclosed to advertisers – essentially generating extra profit from client funds without the clients receiving any benefit. Immediately, every advertiser was checking their contracts for audit rights and transparency clauses, and working to update them asap.

The lack of transparency in the industry had eroded the trust between clients and agencies in a significant way. Trust is hugely important to having confidence that your agency is working in your brand’s interest, and thus a good working relationship. Consequently, client – agency relationships around the world were tested and under pressure following the ANA report.

Major trade bodies (ANA, ISBA, etc) published guidelines and media contract templates that now included standard language to safeguard advertisers (at least to some extent).

Now, a number of years later, many clients still struggle with the level of transparency they receive from their agency partners, and what to do about it, despite all the industry guidelines and templates.

Some of the clients that approach Flock seeking guidance with this issue are looking for complete transparency to agency revenue streams – to understand exactly if and how their agency is making money from the client’s business / funds. These revenue streams include agency fees, for which some clients still don’t have transparency to. Learn more about how the Flock Agency Scoping Tool can bring transparency to the agency fees you pay, and develop the scopes of work you, and your agencies, actually need.

Here at Flock, we think the answer comes down to a relatively simple equation – how much will it cost you to get that ‘full transparency’, compared to what you may get out of it in the end?

To achieve ‘full transparency, audits would need to encompass the number of agency revenue streams that span beyond client fees or AVBs from media owners:

- Agencies will earn interest in the short-term capital markets – by ‘lending’ funds paid by clients to the markets overnight, or for only a few days, before they need to pay media owners, agencies can earn a sizeable portion of their overall revenue

- Agencies also earn rebates from many other non-media activities, just like advertisers do – from travel companies, credit card providers, IT providers, etc

This means that auditing the full accounts receivable of an agency can be very extensive, and extremely complicated to understand an advertiser’s ‘fair share’. The level of work needed to carry out an audit this in-depth usually makes the cost of the audit outweigh the benefit of doing it in the first place.

Thus, ‘full transparency’ as it relates to agency revenue may be a pipe dream, and not worth the cost or effort.

ocusing on media-related AVBs, tech & data costs, and funds paid for yet unbilled media then seems like the logical path, but there are also some nuances to consider here.

We think there are a few key things to do as an advertiser to protect as much as reasonably possible:

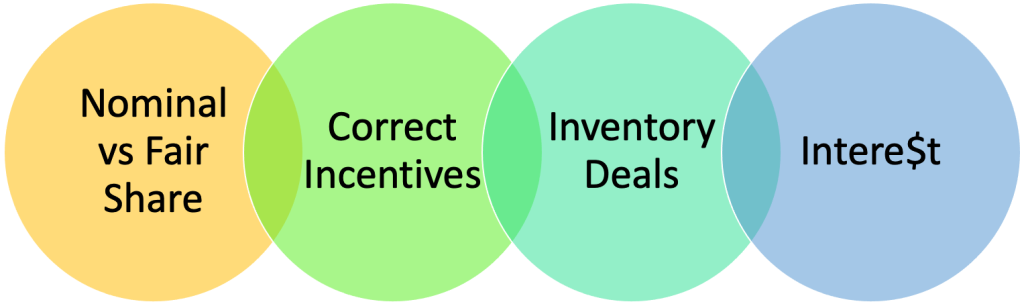

1. Instead of thinking about ‘fair share’ of AVBs, it’s better to consider the nominal amount of AVBs relative to the net investment. Advantageous pricing, or a great job by a media buyer, could work against an advertiser when looking at their share of an overall rebate across many clients.

Additionally, sometimes agencies carve up the rebates using other factors in addition to share of investment – things like new business potential, upcoming pitches, client behavior overall, etc can play a role in who gets what portion of a rebate.

2. Another key way for an advertiser to protect themselves against missing out on AVBs is to remove the incentive for the agency to need to find alternative funding on the account as much as possible. Do this by paying the appropriate fees for the work – focusing solely on fee / rate reduction without reducing the workload commensurately will only lead to either a downskilling of the team or the agency needing to make up a funding gap however they can.

3. We recommend that advertisers seriously consider the lack of transparency vs benefits before taking part in non-disclosed inventory deals. While the inventory in these deals can sometimes look good on a cost basis vs a pool or the market, there is no way of knowing the agency’s cost basis for the inventory, and thus what an appropriate cost level is for advertiser. If you do enter into these deals, go into them with ‘eyes wide open’ that there may be hidden margin for the agency.

4. And finally, by adding a clause to your contract that ensures the agency pays interest on funds held more than a certain number of days before paying a media owner, you can reduce the potential for an agency ‘playing bank’ with your funds, and in a way that you actually can audit. The trick here is to find an appropriate number of days that both parties can agree to – often the agency won’t be able to pay a media owner immediately after receiving client funds, but they shouldn’t be held onto for an excessive period either.

Drop your contact info in the form below to see how Flock can help you manage the transparency you get, and get the transparency you need!